Financial Planning

By looking at your situation holistically, we can tailor a plan that evolves as your needs change.

Growth is a mindset.

In creating a road map to help build, protect and transition your wealth, we look at your financial situation holistically - and with genuine curiosity. We ask authentic questions designed to get at the root of your goals and values, challenge your current path and clarify your strategic choices. And we create solutions and opportunities based on alternative ways of thinking, serving as your guide at every stage of your journey.

To us, this means being innovative, informed and nimble in our approach. We believe the best solutions are aligned with your passions and philosophies. And the best opportunities are flexible and adaptable - ready to change with you as your life changes.

Have a vision for your future? That’s where the conversation begins.

When it comes to planning your financial future, we focus on the connection between your passions and the philosophies that drive your success, helping ensure your trailhead and peak are connected by the same path. To help us better understand your ambitions, we’ve developed a series of Connected Financial Conversations that help explore this intersection thoughtfully and strategically. Whether it’s supporting your favorite charity, planning a business transition, or envisioning your retirement, your best tomorrow starts with purpose-driven conversations today.

We start by talking about you. Then, we discuss where you are in life.

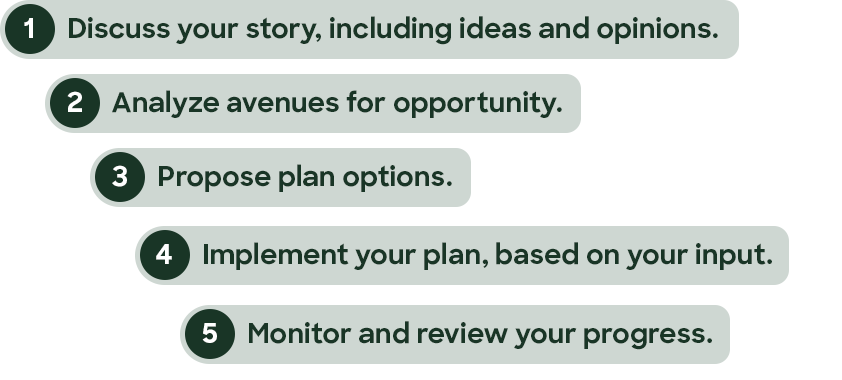

Using these answers, we create a custom-tailored strategy for you and the people you care about most through our five-step process:

Key areas of planning

We believe growth is fueled by understanding. Knowing your purpose brings your complete financial picture into focus, and helping you choose the right solutions and strategies puts you on the right path for growth.

Estate planning

We start with the fundamentals in building a plan that helps ensure your assets are effectively managed and distributed.

Education funding

Whether you're saving for private schooling or college, we help you craft a disciplined plan to help fund your children and grandchildren's education or other family priorities.

Business succession planning

We help you establish a sound succession plan to protect your legacy and achieve your desired outcome.

Cash flow analysis

By tracking your spending and analyzing the results, we can help you identify opportunities to improve cash flow and make smarter decisions with your money.

Insurance strategies

Protect your loved ones and assets when the unexpected happens with our smart risk management and insurance strategies.

Retirement planning

Balance living well now with retiring better, later. Your private wealth advisor can help you create a flexible plan that considers current cash flow needs and your dreams for tomorrow.

We’d love to get to know you.

Please provide as much detail as possible so we can connect you with the right financial professional. Your answers will also help inform the types of conversations we have.

Phone: (833) 898-0973

Note: This mailbox does not manage account-based service requests.

We suggest you not provide account information or trade requests, as they cannot be processed through this form. Instead, please contact your Financial Professional directly. Thank you.